The sharp rally in Nvidia ( NVDA 0.03 %) stock shows no signs of slowing down. With gains of almost 89 % so far in 2023, the semiconductor behemoth has handsomely rewarded investors, and it appears that the hype surrounding artificial intelligence ( AI ) may help it maintain its incredible stock market momentum.

The addressable market for Nvidia's's graphics processing units( GPUs ) could significantly increase as a result of the expanding use of AI applications, greatly boosting the business of its rapidly expanding data center.

That shouldn't come as a surprise given that the well-known robot ChatGPT from OpenAI is said to use 10,000 Nvidia GPUs. As OpenAI expands ChatGPT to meet the rising demand for ai, that variety is anticipated to surpass 30, 000.

A lack of Nvidia's's Nvidia is being caused by the booming demand for design tickets for AI applications, according to scientist Dylan Patel of semiconductor research company SemiAnalysis. According to CEO Jensen Huang, the need for the company is increasing as a result of the popularity of relational AI last month.

Do investors who have so far missed the Nvidia gravy train in 2023 purchase the stock now in the hopes of reaping greater rewards? Let's's find out more.

Nvidia's's claim will be greatly increased by AI.

According to market research firm Research Dive, demand for AI accelerators like central processing units( CPUs ), GPUs, data processing systems, and other chips could increase by 39 % annually through 2031, bringing in a staggering$ 332 billion in annual revenue. Nvidia is well-positioned to seize this enormous business.

According to New Street Research, Nvidia is in charge of 95 % of product reading Graphics. The study company notes that its$ 10, 000 A100 GPU has emerged as the industry standard for powering AI tasks in data centers and microprocessors. Unsurprisingly, OpenAI trained ChatGPT using dozens of A100 Graphics, and it is not the only AI platform to use Nvidia's's chips.

Nvidia's's A100 GPUs are also used by Stability AI, a company known for its Stable Diffusion productive AI platform, which may transform text into images. 32 of these Nvidia were used by durability AI last year; by February 2023, that number had risen to 5, 400. Sales of GPUs intended for AI workloads should soar as the generative AI market is predicted to experience 21 % annual growth over the next ten years, rising from just under$ 9 billion last year to more than$ 126 billion in 2033.

Nvidia should be able to keep up its fantastic rise in the data center industry as a result. Revenue from the company's's data center has increased from just under$ 3 billion in 2019 to$ 15 billion by 2022. Last fiscal year, the segment accounted for 55 % of Nvidia's's total revenue, up 41 % from the prior year. Despite sharp declines in the entertainment and experienced modeling industries, Nvidia's's overall sales in financial 2023 remained flat year over year at$ 27 billion due to this strong growth.

And now, the business is broadening the application of its AI system through a cloud-based service called DGX Cloud, which will enable businesses to create productive AI applications without spending significant sums of money on hardware. Nvidia is now able to profit from a competition that is expanding quickly. Companies won't have to spend a lot of money to set up the necessary infrastructure thanks to cloud-based AI GPU services, which they can only rent from Nvidia.

Nvidia mainly offers its Graphics as a support. According to Global Market Insights, the market for GPUs as a service could be worth more than$ 80 billion by 2032, up from only$ 5 billion in the previous year and clocking 30 % annual growth over the following ten years. Therefore, even as it faces difficulties in the personal computer ( PC ) market, the data center business will continue to move the needle in a significant way for the company and drive growth.

Is it worthwhile to buy the stock right today?

Nvidia is highly valued at 155 years trailing earnings. The price-to-sales amount of 25 more reveals how expensive Nvidia stock is at the moment in light of its spectacular increase in 2023.

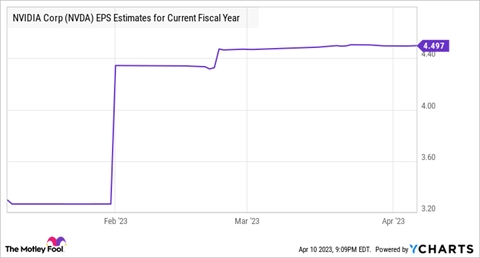

However, a 60-percent along price-to-earnings amount reveals significant change in the bottom line. Given the exceptional rate at which Nvidia's's earnings may increase from the$ 3.34 per share figure from earlier fiscal year, that is not surprising.

It is important to note that Nvidia's's top-line growth is anticipated to pick up speed in the financial years 2024 and 2025.

Due to the enormous potential in AI and data centers, it didn't come as a surprise that Nvidia is growing more quickly than Wall Street is. Therefore, before Nvidia becomes more cheap, people looking to profit from the AI growth and who are willing to pay a high different for the market's's dominant player in the rapidly expanding billion dollar market may buy it.

If the challenges in the PC markets continue to weigh on the stock's's growth, people with a lower appetite for risk may have the opportunity to purchase it at an essentially lower rating. They don't overlook the fact that the data center industry is now larger than play, and the former industry's's rapid expansion may be sufficient to offset PC weakness and drive the stock higher. Simply put, the warm march for Nvidia stock appears to be staying.