Investors have low expectations for Microsoft in 2023( MSFT - 1.28 %). Most Wall Street experts predict that the tech behemoth will significantly increase sales and earnings after making significant benefits over the previous two years. However, compared to many of its technology peers, the property is valued at a significant insurance.

Does that price reflect Microsoft's's value as a long-term expense, or does it imply that over the coming decades, owners will likely experience sluggish returns? Let's's look more closely at the bullish thesis for the stock.

weak spots

The strength of Microsoft's's unique business was demonstrated in its most recent earnings report, despite the company still facing significant growth obstacles. After accounting for currency exchange rate changes, prices increased total by 7 % to$ 53 billion by the end of December. On that basis, revenue was up 16 % in the previous quarter.

Shareholders may see significant differences between Microsoft's's key business lines by zooming in. Cloud services, which increased 22 % in the fiscal second quarter, are where growth is strongest. However, the business is experiencing a continuous decline in video games and PC items. These crosscurrents contribute to the explanation of why Wall Street anticipates sales to increase at a single-digit price in financial 2023.

monetary fortitude

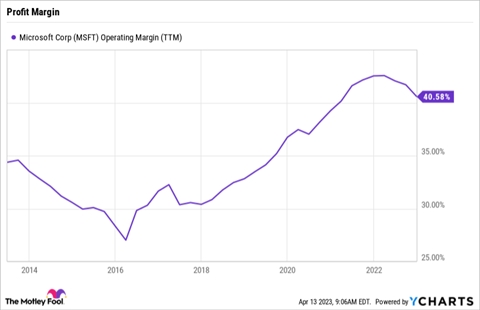

Although Microsoft's's financial power is modest, it still outperforms the majority of its competitors in this market. Despite a 2 number point decline in operating profit margin last quarter, prices are still higher than record-breaking 40 %. At a time when many software and hardware companies are struggling, that number is higher than the majority of competitors and is also holding steady.

Microsoft's's money posture will also have a lot to appeal to people. In the most recent quarter, the software as a service( SaaS ) specialist generated over$ 11 billion in operating cash flow and$ 5 billion of free cash flows. Despite the fact that both numbers are lower than epidemic spikes, they show a highly effective business with aggressive moats that cover areas like cybersecurity, enterprise cloud services, and business productivity.

assessment and cash earnings

Microsoft executives stated in a conference call in late January that large customers are being more cautious when it comes to business spending. These styles point to a further half of fiscal 2023 that closely resembles the Q2 efficiency, along with an ongoing decline in markets like Computer and video games.

Microsoft's's recent stock movements conflict with that shaky short-term outlook. Shares are currently worth more than 10 times annual revenue and are outperforming the S & ampP 500. From 8 years revenue in late 2022, that rating has increased.

Therefore, overpaying for this outstanding company carries the biggest danger with Microsoft stock. When markets turn significant once more due to concerns about a possible recession on the horizon, cautious investors may want to keep an eye out for better opportunities to purchase.

Microsoft now appears to be a great long-term choice, even though the stock's's 2023 protest has reduced possible returns from here. Over the course of many years, maintaining this company and the picture it brings to important growth sectors like AI and cloud services will probably produce significant returns. An increased stock valuation don't deter investors from achieving those advantageous outcomes.