Before Shopify's's upcoming earnings update( SHOP 1.44 %), investors have some important questions. The expert in e-commerce platforms will discuss whether sales volume traits are stabilizing after slowing for different rooms in early May. Following a challenging year of loses in 2022, Shopify may also demonstrate progress toward improving the company's's funds.

Let's's look more closely at the upcoming Shopify results and what they might mean for current growth stock buyers.

The important queries

Whether Shopify's's primary company has stabilized is the main query for the Q1 email. In fiscal 2022, gross merchandise volume increased by just 16 % as opposed to a 47 % increase in the previous year. Investors worry that the slowdown may last into 2023 as consumers continue to return to in-person shopping in their investing.

Through development initiatives like Shopify's's expansion into payments production, it can help to offset some of that stress. If the price increase didn't cause too few delays in Q1, higher prices for merchants will also be beneficial. The majority of investors anticipate a 19 % increase in sales this quarter, reaching$ 1.43 billion.

balancing competitiveness

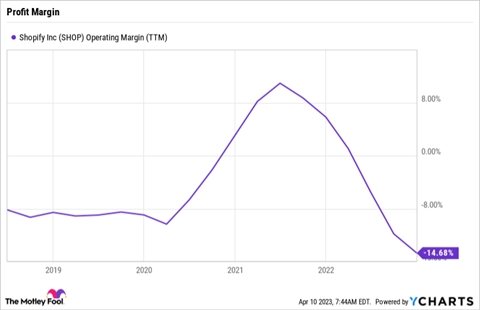

People anticipate significant commercial advancements in 2023. After all, slowing growth, a push toward lower-margin payments production sales, and soaring spending were all significant headwinds that hurt earnings last year. In contrast to a profit of$ 269 million, or 6 % of sales, in 2021, Shopify reported an$ 822 million net loss last year, which is equivalent to 15 % of all sales.

Operating income was 0 % of sales next year compared to 16 % a year ago, even on an lowered basis. Over the coming quarters, Wall Street will therefore be watching for a rise in this key metric.

Observing the future

The updated 2023 outlook from Shopify may provide the answers to some important questions people have about the company's's growth and profitability prospects. According to the Q1 report, sales are expected to increase in the high teens portion range while profitability significantly increases.

After last year's's pandemic-related growth hangover, management observes e-commerce demand trends returning to a more normal level. These higher subscriber plan fees may also benefit Shopify.

The negative risks include careful consumer spending brought on by inflation and sluggish economic growth rates. Shopify faces fierce competitors as it tries to attract more stores of all types.

However, planning is upbeat about Shopify's's potential to grow from its current market have situation, which accounted for about 10 % of e-commerce sales in 2023. With the aid of an expanding range of merchant services, including a growing realization system, the company may increase that number over effort. Shopify President Harley Finkelstein stated in mid-February that" merchants used more of our mission-critical applications to run their businesses ," and the system will receive many more updates this year.

Before its recovery path becomes more clear, investors who are willing to take some risk may be tempted to purchase the stock today. However, before declaring Shopify an appealing growing property, the majority of people will want to see some improvement in profitability.