Constellation Brands' ( STZ 0. 90 %) business is almost back to normal. The alcoholic drink behemoth, which is the owner of well-known imported beer brands Corona and Modelo, recently reported solid fourth-quarter sales and earnings results that gave the business excellent momentum for the upcoming fiscal year. Constellation Brands has the flexibility to invest in growing efforts especially while returning money to shareholders thanks to financial victories.

Let's's look more closely at those findings and why they indicate that individual people will experience strong returns in the future.

Beer triumphs

Both Constellation Brands' beer and wine groups are performing well, but they do so in several ways. Market share growth in the core beer segment has been crucial, with depletions, a gauge of consumer sales, increasing by 6 % in Q4.

The business performed particularly well among higher-priced trade beers and gained market share in the larger beer niche. In a press release, CEO Bill Newlands stated that" the momentum of our iconic and next wave beer brands continued our ... share gains."

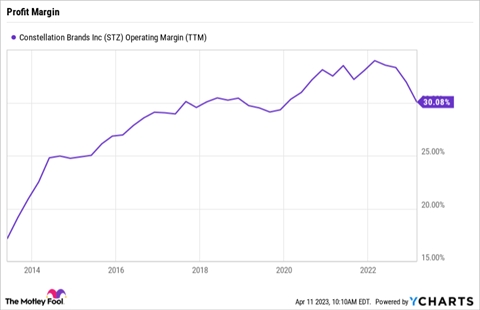

As price increases followed rising costs, that triumph was tempered by a decline in revenue. Beer margins at Constellation Brands decreased from 39 % of sales a year ago to 34 %.

a bottle of red

Although the wine market didn't expand being quickly, management's's turn plan did. Overall depletions decreased by 3 % for the entire year in Q4 while falling 5 % overall. Operating profit margin increased from 22 % of sales a year ago to 28 % thanks to the company's's shift toward the premium end of the industry.

These accomplishments made the larger business's's commercial performance good. Free cash flow for Constellation Brands increased by 3 % from fiscal 2022 to$ 1.7 billion for the year. Core earnings also increased 4 %. By spending$ 2.3 billion on earnings and share buybacks over the previous 12 months, administration showed that direct cash arrives were their top priority.

Observing the future

As the organization devotes more resources to its brewery upgrades in Mexico, those money returns may lower somewhat in the upcoming new financial year. However, Constellation Brands' financial 2024 outlook now has a lot to appeal to investors.

Even as prices development approaches 10 %, management predicts that profit margin falls in the beer industry will diminish. As sales decline by less than 1 % and operating income increases by between 2 % and 4 %, the wine and spirits segment will take another step toward maintaining strong earnings.

Constellation Brands isn't likely to let its individual shareholders down, despite the fact that these forecasts may change as individual spending habits change throughout the year. Following its lengthy reform process, the wine and spirits department is now prepared to start contributing to earnings as a result of its growing hold on sizable portions of the beer market.

The store isn't cheap at all. Shares are trading for almost five years quarterly sales, or roughly twice what Wall Street currently values Anheuser-Busch InBev. However, in earlier stages of the pandemic, Constellation's's PS amount had been as high as nearly 6 times sales. The fact that this pricing has decreased recently despite the growth stock improving on its sales and profitability changes is encouraging for future earnings.