Retirement trading can be seen in a variety of ways. Some people may prefer to maintain their conservatism and simply watch day and compounding accumulate. People might want to have on a lot of harm because they will have years of work-related income to offset any losses.

In actuality, both are correct. It probably isn't a good idea to be too aggressive when attempting to hit someone who has accumulated enough money to retire, even if they have worked for decades. A combination of those two strategies probably makes the most sense because even some fairly conservative investments have the potential to be huge winners over time.

Below are two stocks that you should have in your investment if you want to invest for a long time.

Be willing to take some risks

Tesla( TSLA - 0.48 %) has grown to be a very profitable and prosperous business with years and decades of potential for expansion. But by conventional standards, it's's obvious that it isn't a cheap stock. This is due to the fact that investors believe Tesla's's energy business and the electric vehicle ( EV ) industry have a very bright future. Based on 2022 earnings, its stock recently traded at a price-to-earnings ( PE ) ratio of about 52.

There is a real possibility that Tesla's's 2023 earnings won't rise drastically, despite the wide range of researcher projections. As a result of the competition's's sharp increase in EV opportunities, the company has reduced vehicle sales. However, for those who can look past a possible lack of short-term returns, it can still be an excellent choice.

The expansion of Tesla's's two most recently opened automobile companies in Texas and Germany is still in its earlier stages. It has already revealed plans for its second facility, which will be located in Mexico.

Additionally, it plans to build a new battery storage shop next to its engine place in Shanghai and expand the factory in Nevada that serves its power and energy-storage companies.

Since it still generates free cash flow, all of these ventures are being financed with money from its ongoing operations.

On April 19, when Tesla releases its first quarter 2023 wage, a number of factors will be highlighted. All eyes will be on how the company's's pricing changes have impacted its profit margin.

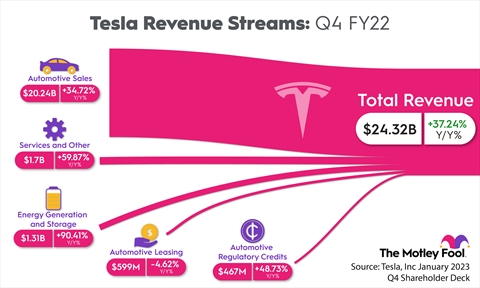

However, cautious individuals will also be interested in the growing rates of its non-EV businesses. As can be seen in the graph down, Tesla's's energy and getting parts experienced significant growth during the third quarter and are now a significant source of revenue.

Tesla has a lot of potential, even though there are risks associated with its original assessment and from increased competition. People who are planning to retire in the future may discover that it is a good match for their portfolio.

Make a small amount of money into much

The adage" past performance does not predict proposed results" is frequently used. However, there are times when it is worthwhile to review that previous performance. One of those investments that qualifies is Home Depot( HD 0.01 %). not only because of how well-received it is by individuals, but also as a result of its enormous success. I'll'll use a personal story to illustrate that.

Even over 20 years ago, I bought stock in Home Depot. Over those two decades, the share-price appreciation alone has yielded a healthy 14 % annual return, but that's's not the only advantage I'll'll experience in retirement. On that get in 2003, the property offered just a 1.2 % annual dividend yield. However, as the company has prospered, administration has gradually increased its income.

The ongoing income from Home Depot now yields 40 % on my initial choice. Or, to put it another way, if you had invested$ 10,000 in Home Depot stock at the beginning of 2003, you would now be receiving dividend payments of more than$ 4,000 annually.

That is a beneficial source of income for retreat. Additionally, there are no indications that Home Depot's's market is slowing down. In order to better serve its multifamily housing customers, it recently made a push into the professional market. Older houses will need to be maintained while new property are still being built. As its company expands, the share price may keep rising.

That may create Home Depot a fantastic retirement investment in terms of both income and capital growth. There is no reason to believe that the company's's past performance won't also lead to better outcomes in the future.