Two of the top-performing tech stocks over the past ten years were Nvidia( NVDA 2.46 %) and Apple( AAPL 0.75 %). Nvidia made a 8, 100 % return, while Apple's's stock increased by 985 %.

These results show that Nvidia's's market was expanding more quickly. This is largely due to Nvidia's's smaller size than Apple and the fact that it sells its high-powered graphics processing units( GPUs ) into the expanding data center market brought on by the use of artificial intelligence ( AI ) and other advanced computing applications.

Nvidia now has a high much ceiling to outperform Apple for several more decades because it estimates its growing ability at more than 20 times its current monthly income. Apple, however, is not still, as evidenced by the fact that it already has a$ 2.6 trillion market cap( stock price times total shares outstanding ), as opposed to Nvidia's's$ 660 billion.

Establishing a proposed worth for Apple using good growth and valuation assumptions is the first step in determining the answer to the key question in this case. Now, you can more accurately estimate the market value increase that Nvidia's's store needs to experience in order to surpass Apple.

estimating Apple's's value in the future

Apple's's speedy implementation of the phone was the main factor in its expansion over the past ten years. However, as the smartphone market has become more concentrated globally in recent years, it has slowed.

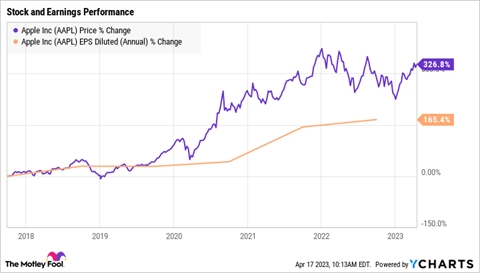

One of the main factors driving Apple's's stock to rise in recent years is the higher margins from services business. Services grew from 14 % of total sales to almost 20 % between fiscal 2017 and fiscal 2022. Apple's's earnings per share( EPS ) more than doubled as a result of the higher-margin sales and the management share repurchase program.

For the immediate future, growth in both hardware and products could drive Apple's's share higher. The services industry still has a" large long-term opportunity ," according to CFO Luca Maestri in Apple's's most recent business update.

A mixed-reality helmet that could be unveiled later this year and Apple smart glasses that will follow are among the different products on Apple's's component section that are rumored to be under advancement. Additionally, there have been persistent rumors that Apple is developing a vehicle. Within the next five days, all of these products may be released.

In the financial year 2022, Apple earned$ 6.11 per show. Apple would have earnings of$ 16.25 per share in 2030 if its increasing margins from services and continued hardware growth can increase its earnings per shared by about 15 % annually, consistent with previous years.

The share price may be$ 406, or a market cover of$ 6.4 trillion, if the property were trading at an earnings-to-price amount of 25, which is significantly lower than its current two of 28.

Nvidia is on the prowl for a demon.

You can already see how difficult it will be for Nvidia to keep up with Apple. In order to enhance Apple's's anticipated market cap in seven days, Nvidia would need to increase its share price by at least 800 % from the current share price.

Yes, it's's possible that Apple won't increase its earnings as much as anticipated. Apple won't be as valuable and Nvidia will have an easier time catching up if earnings grow slower, say 10 % per year, in line with Wall Street estimates.

However, this works both ways. Nvidia is in a cutthroat semiconductor industry, and as its most recent sales achievement demonstrates, the graphics professional is also susceptible to cycles in chip demand.

Gaming GPUs, Nvidia's's second-largest market, saw a sharp decline in sales last year as sluggish consumer demand. Due to tightening sky taking budgets over economic headwinds, Nvidia is already beginning to notice slowing growth in its largest market, data centers.

Which property is the best to purchase?

It's's not improbable that Nvidia could one day surpass all other companies in value, despite the fact that it trades at an expensive 59 times the earnings estimates for this year. However, it is doubtful to surpass Apple in the time frame mentioned.

It is safer to predict that Nvidia stock will surpass Apple share over the long term, even as it has for the past ten years, as AI becomes a bigger opportunity than the market previously thought.