Last year, the property market threw investors a ball, with highly valued growth stocks suffering the most. The growth-heavy Nasdaq Composite is currently low 26 % from its former high, but for long-term investors, these sudden changes in market prices may open up fantastic buying opportunities.

The strongest business will eventually reclaim their positions at the top, despite the fact that market corrections and bear markets typically bring it down with them. E-commerce is one sector that will only continue to expand and result in long-term finalists.

The share prices of Amazon( AMZN-1.56 %) and PayPal Holdings ( PYPL-0.86 %) have fallen significantly over the past year, but these businesses are in a good position to recover.

1. Amazon.

Amazon's's stock has dropped 45 % from its all-time peaks. There are a number of justifications for using the settlement.

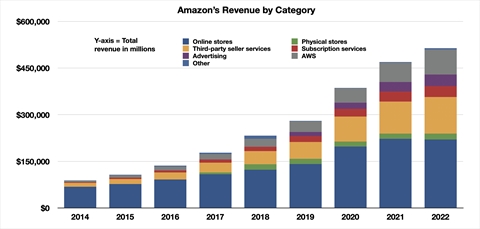

Amazon's's year-over-year development has received a lot of attention, which has caused the stock to decline. Revenue increased by 20 % in 2019, 38 % in 2020, 22 % in 2021, and only 9 % in 2017. However, Amazon's's overall revenue is 77 % higher than it was in 2019. The majority of that growth is attributed to higher-margin products like subscriptions, strategies, and cloud services.

The financial operation's's affordable moat has grown as a result of management reinvested its free cash flow over the past few years and doubling its accomplishment infrastructure. Since it's's difficult not to justify buying everything from Amazon once you're're a Prime member, these expenditures should result in more growth. This will be advantageous for Amazon as it continues to expand into a global e-commerce market that is predicted to reach over$ 7 trillion by 2025.

Additionally, Amazon's's stock management practices have improved. In order to reduce costs and expedite delivery to Prime members, it has improved the selection of goods at local fulfillment centers all over the United States. Additionally, this will yield significant income over period.

Of all, Amazon invests heavily in cutting-edge systems like high-performance computing and artificial intelligence. This includes, among other things, product tips and the Alexa style assistant. People don't undervalue Amazon's's capacity to use this crucial technologies to discover new places of growth over time.

The competition may be considerably undervaluing the company ahead of these programs given that the stock is trading at its lowest price-to-sales amount in nearly a century.

2. 2. PayPal.

PayPal stocks are 75 % lower than their earlier highs. The stock is currently priced with a lot of good information, making it an appealing contrary choice.

With 435 million active accounts, PayPal is a leading provider of electronic purchases. Since 2015, it has almost doubled its energetic statements, but like Amazon, slowing growth has caused the supply to fall far below its former highs.

Wall Street is pointing at market for PayPal's's slowing impulse, despite the fact that most investors are aware of the extremely tough pond encircling the Amazon company. These vulnerabilities should be taken seriously for a number of reasons.

The landscape of electronic payments has become more competitive in recent years. The biggest danger is Apple, which offers a ready-made markets for Apple Pay thanks to its sizable installed base of phone users. When the business partnered with Goldman Sachs to provide a credit card in addition to its digital wallet, it strengthened its competitive situation in the mobile payments competition.

However, these competitive dangers are generally overstated. With 35 million vendor partners, PayPal has a significant advantage over customers. PayPal's's overall transaction volume is still rising, rising 13 % year over year in the fourth quarter, thanks to this two-sided network that links individual users with brands.

PayPal doesn't have to expand as quickly as it did prior to the crisis, despite the fact that it may not. Based on this year's's earnings projections, the stock has a moderate price-to-earning amount of 15 which indicates that the marketplace has low growth prospects. The standard stock's's income two of 22 is significantly reduced by that.

However, planning predicted an adjusted earnings per share increase of about 18 % in 2023. This results from efforts to manage cost, which appear to be a sure way to increase earnings over the coming years and provide investors with returns.

I think PayPal will be able to continue producing better-than-expected earnings growth than the market is currently anticipating thanks to the natural benefits of its widely used payments system. PayPal property could be a bargain at its present value if the company follows through on its guidance.